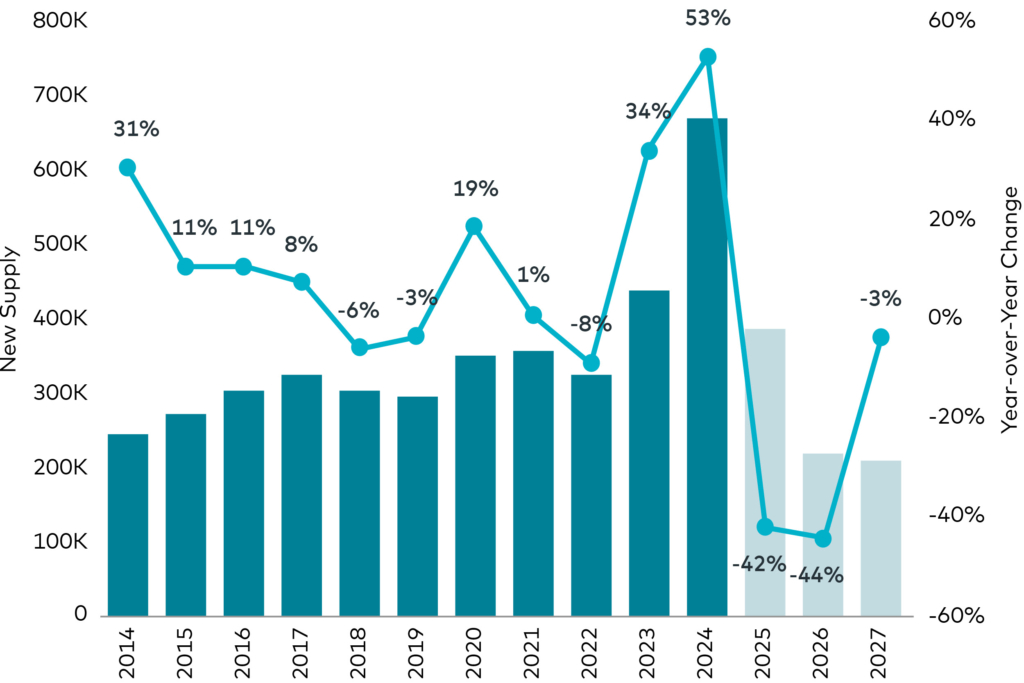

This year, new supply is expected to surge 53% year over year

Metrics Monitor

Multifamily Supply Glut Heads Toward Steep Drop-off

In 2023, nearly 440,000 new multifamily units were delivered, according to research by Newmark. This year, new supply is expected to surge 53% year over year—and then plummet by 42% in 2025. That’s still higher than the historical average, but projected supply delivery in 2026-27 won’t recover to even recent pre-pandemic levels. And lending conditions crimped by 2023 bank failures and the ensuing financial market turmoil have made it harder for developers to secure financing for new projects. At the same time, rising material costs and labor shortages have increased construction costs, which can deter new projects as margins compress.

This increased supply has softened rents, but despite vacancy rates above pre-pandemic averages in 2024, demand will keep average occupancy above 94%, according to CBRE. With new housing starts not happening at the scale necessary to meet long-term demand, we believe that the supply gap, along with stronger rent growth generated in 2025-26, will lead to new investment opportunities.

U.S. Multifamily Supply

Source: Newmark research, RealPage