Should Investors Vote Blue or Red?

By, Matt Benjamin, Senior Markets Expert, The Oxford Club

In a presidential election, should smart business owners, CEO’s and investors vote for the Democrat or the Republican?

It’s an age-old question, and it’s becoming relevant again as the 2024 election season approaches and business owners, CEO’s and investors start eyeing the polls.

Invariably, each election delivers hysterical prognosticators who tell us the market will tank under a particular candidate.

On election night in 2016, when it looked like Donald Trump would beat Hillary Clinton, and New York Times opinion columnist and Nobel laureate Paul Krugman predicted apocalypse.

“Markets are plunging,” Krugman wrote that night. “If the question is when markets will recover, a first-pass answer is never.”

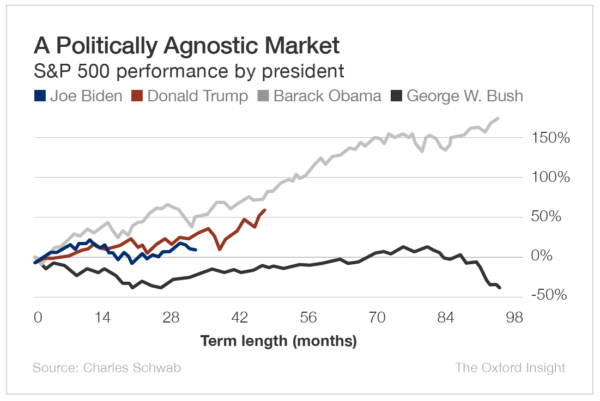

He was dead wrong. While the market went for a wild ride over Trump’s four years in the White House, the S&P 500 Index was 63% higher when he left office.

Similarly, I have Republican friends who predicted an utter market collapse under Barack Obama.

Yet the S&P was up 176% over his eight years in office.

For comparison, the market has struggled a bit during the Biden administration and is up just 14% over Joe Biden’s first 33 months as president. And the market fell almost 40% during George W. Bush’s eight years.

As the chart below shows, it doesn’t make that much difference to the market whether the Oval Office occupant is a Republican or a Democrat. (You can compare the S&P performance under presidents going back to Herbert Hoover here.)

That isn’t to say that a president’s policy choices don’t matter.

It’s All About the Policies

Regulation and tax policies influence the behavior of companies and individuals.

Just as important – and maybe more so – is fiscal stimulus. If you pump a lot of money into the economy, chances are that consumers and businesses will spend it. And that spending will drive corporate profits up and, eventually, stock prices higher.

And boy, oh boy, have we had fiscal stimulus in the past few years!

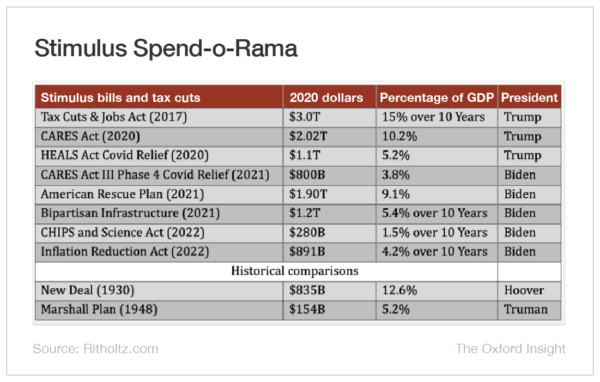

Trump’s 2017 Tax Cuts and Jobs Act amounted to $3 trillion in economic stimulus over 10 years. That’s bigger (as a percentage of GDP) than the entire New Deal pushed through under Franklin Roosevelt. The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 amounted to another $2 trillion. Overall, Trump’s administration enacted about $6 trillion in stimulus spending.

Biden has tried to match that. His administration has overseen the passage of five pieces of stimulus legislation that total just over $5 trillion.

As you can see in the table below, these numbers (all adjusted for inflation) dwarf both the New Deal and the Marshall Plan.

Yes, I’m well aware most of this government largesse is deficit spending, and that the national debt has ballooned to more than $33 trillion. And yes, eventually, there will be consequences to this uncontrolled borrowing.

Monetary policy, however, matters just as much as fiscal policy. And unfortunately for Biden, the ZIRP – zero interest rate policy – era is over. Just about 13 months into Biden’s term, the Federal Reserve embarked on the steepest interest rate hiking cycle in four decades.

That marked the end of easy money.

What Will 2024 Bring?

The 2024 presidential election could be very important indeed, and you’ll want to have a plan for it no matter who wins.

The reality is that smart American businesses find ways to succeed no matter who’s in charge.

In recent years, recycled building materials have become increasingly popular in the world of construction and home design. From glass to newspaper, your recyclables are being turned into a wide range of unique and useful building materials. Here’s a closer look at some of the latest advancements.

In recent years, recycled building materials have become increasingly popular in the world of construction and home design. From glass to newspaper, your recyclables are being turned into a wide range of unique and useful building materials. Here’s a closer look at some of the latest advancements.