Experts Predict Housing Recovery in Late 2024 through 2025

Population increases, job growth, and cooling inflation deliver good news for construction-related wholesalers, manufacturers and tradespeople serving the housing industry.

By Kerry Stackpole – The Wholesaler

Economic and real estate experts have forecasted a housing recovery in late 2024 through 2025, delivering good news to plumbing manufacturers, distributors and construction-related trades that serve the housing industry. Population and job growth, shifting demographics and cooling inflation in the United States are set to fuel higher home sales. At the same time, some challenges remain for the commercial and multifamily real estate markets.

Job growth — which has been positive so far this year — will drive long-term real estate demand. A strong job market typically means better worker pay, which translates to higher housing demand. The Bureau of Labor Statistics (BLS) shared an encouraging update in March: employers added 303,000 jobs, reaching above the average monthly gain of 231,000 over the last 12 months.

BLS also notes that total payroll jobs have increased by 5 million compared to pre-COVID-19 highs. Many workers who accepted new jobs this year plan on making major lifestyle changes that involve buying a new house or car, reported a ZipRecruiter survey.

With inflation expected to cool, lower mortgage interest rates over the coming months will help boost existing home sales. The National Association of Realtors (NAR) expects existing home sales to increase because 30-year mortgage rates have likely peaked, and the Fannie Mae Home Purchase Sentiment Index is improving.

The index is above 70 percent after hitting bottom at about 57 percent in 2022, reports NAR chief economist Lawrence Yun, Ph.D. In March, he presented an optimistic real estate outlook at the Plumbing Manufacturers International (PMI) Washington Legislative Forum and Fly-In. In its April housing market forecast, Fannie Mae projected that mortgage rates will drop to 6.4 percent by the end of this year and continue falling through 2025.

Experts believe that flattening rent prices will help reduce the Consumer Price Index (CPI); this price increase relief could allow the Federal Reserve to cut interest rates. Yun noted the CPI dropped to 3.1 percent in January, down from its 2022 peak of about 9 percent.

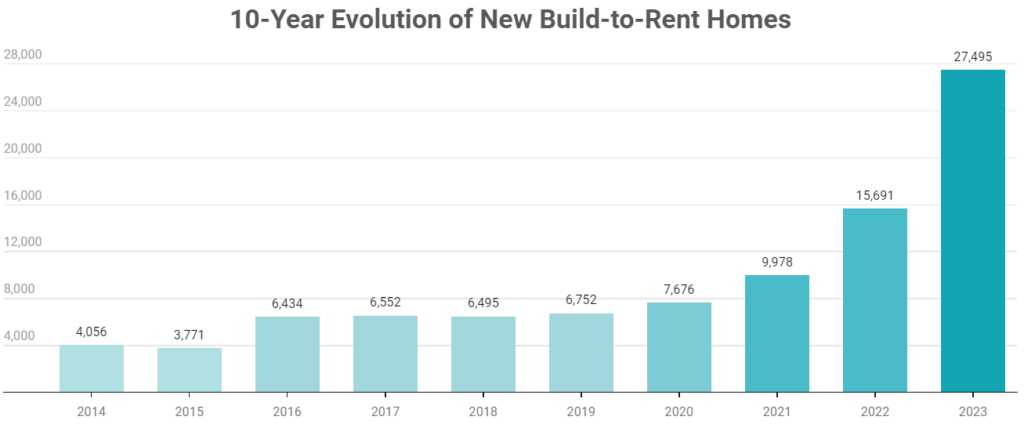

Strong Housing Starts Invigorate Building-Related Product Sales

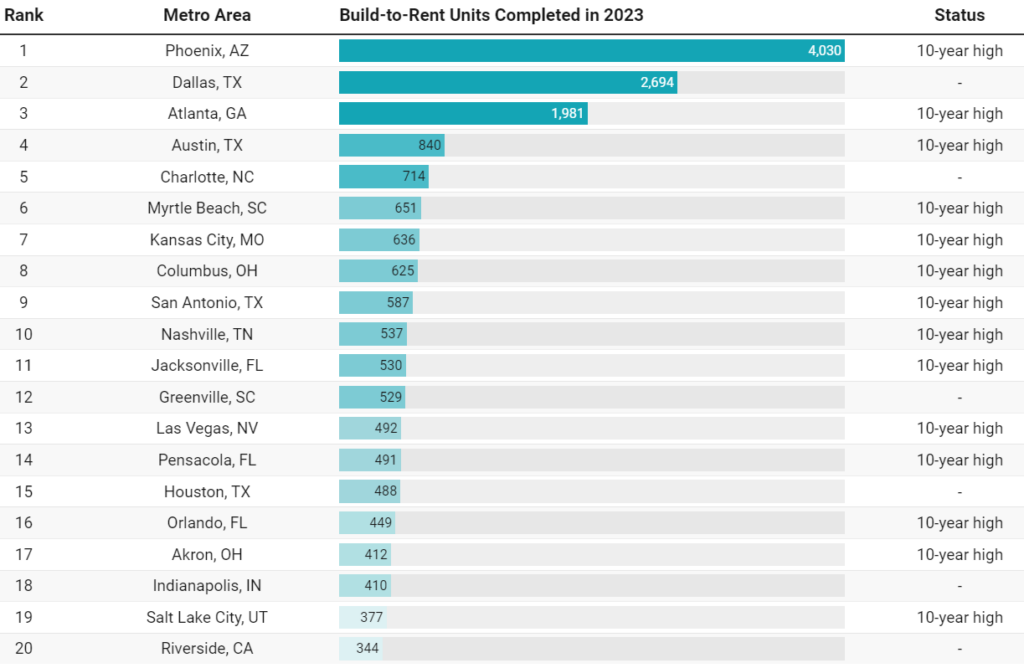

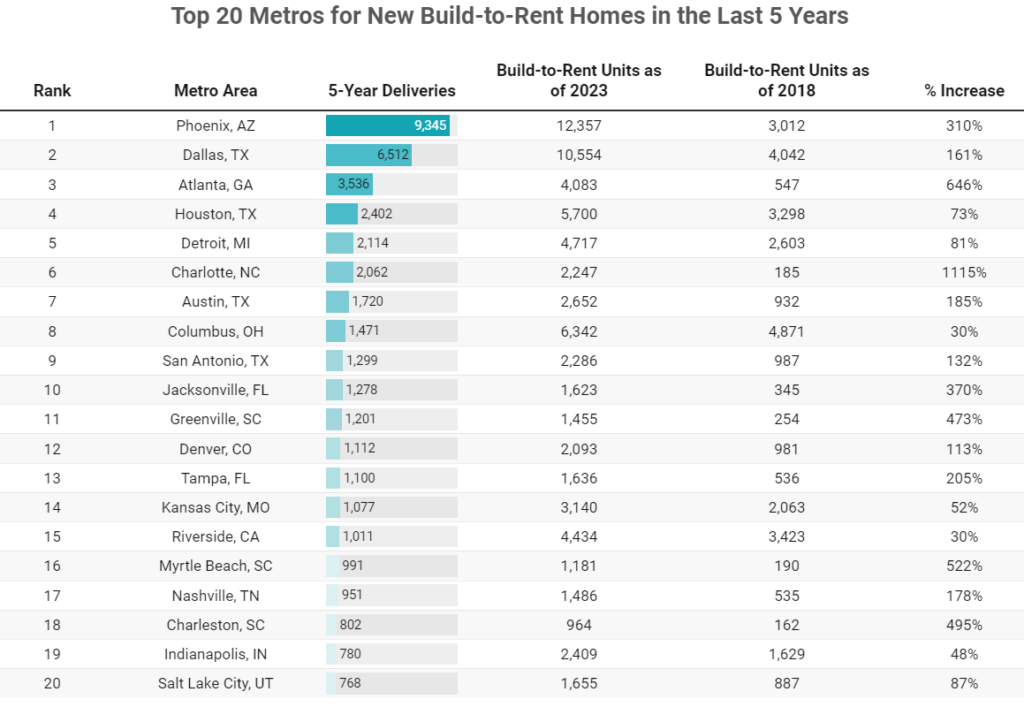

After the housing market experienced a recessionary phase that started earlier than the rest of the economy, existing and new home sales are poised to make headway. Permits for single-family housing starts are up across the country, with some states seeing accelerated growth. NAR expects housing starts to increase by 1.2 percent to 1.43 million in 2024, and by 4.9 percent to 1.5 million in 2025.

New home building will be particularly robust in Texas, Florida and Indiana, where single-family housing unit permits are up 44 percent, 27 percent and nearly 50 percent, respectively, ITR Economics’ Connor Lokar told PMI members during PMI’s April Market Outlook LIVE presentation. This improving housing trend will translate to higher wholesale volume and invigorated customer orders for plumbing fixtures, fittings and other construction-related items, he says.

Ultimately, NAR estimates that existing home sales will grow 9 percent to 4.46 million in 2024, and an additional 13.2 percent to 5.05 million in 2025.

The need for more housing has local governments getting creative by reconsidering lot size requirements, zoning laws and other policies. For example, the Washington Post reports that Sheboygan, Wis., is partnering with local employers, including PMI member Kohler Co., to build 600 entry-level homes — priced around $230,000 to $250,000 — to attract more front-line manufacturing workers. The county will also provide downpayment assistance to buyers.

Other cities — such as Portland, Ore.; Austin, Texas; and St. Paul, Minn. — have changed zoning laws that allow building up to four homes on one lot.

Growing Population, Life Changes to Sustain Home Sales

More people in the country and changing life events, such as retirement and job switches, are causing positive shifts in the housing market.

U.S. population growth is on the upswing, contributing to pent-up home-selling demand. In the U.S. Census Bureau’s January estimates, the nation’s population grew by 1.6 million to a total population of 334.9 million — reaching its highest level since the pandemic.

Yun cited life changes occurring over the next two years that will boost total home sales to pre-COVID levels: 7 million births, 3 million marriages, 1.5 million divorces, 7 million Americans turning age 65, 4 million deaths, 5 million new jobs created and 50 million job switches.

Generational buying habits are changing, too. Millennials have surpassed baby boomers to become the largest group of homebuyers at 38 percent, and Gen X buyers are the most likely to purchase a multigenerational home at 19 percent, according to the NAR 2024 Home Buyers and Sellers Generational Trends report. Baby boomers remain the largest generation of home sellers at 45 percent.

Millennials are selling because their houses are too small or their family situation has changed, while baby boomers and the Silent Generation members (born between 1928 and 1945) are selling to move closer to family and friends or because their homes are too big.

Challenges Still Ahead

Some challenges and concerns remain. Outlooks in the commercial, multifamily and remodeling sectors will not be quite as favorable, especially as the overall economy begins to soften later this year.

Sitting at about 3.5 percent on April 18, the U.S. inflation rate is unlikely to come down to the below 2 percent levels seen before the COVID-19 pandemic, Lokar explains, because of factors ingrained into the economy, such as government spending and the cost of labor. Commercial and nonresidential markets will lag, and multifamily housing demand will drop off in the short term.

Lokar notes a positive result from slow economic growth at the end of 2023 and early 2024: less supply chain pressure. While supply chain recovery is creating excess inventory issues, building material and plumbing product retail sales should begin to progress in late 2024 with improved housing fundamentals.

After a tense period of tight housing inventory with higher home prices and mortgage interest rates, it’s heartening to see rising housing starts and strong job growth. While our economy may face a few obstacles, we can use the forecasting information real estate and financial experts provide to pivot and innovate — as our industry has admirably done for decades.