KCMA: August cabinet sales jump month-over-month

By Larry Adams

WOODWORKING NETWORK

October 23, 2023

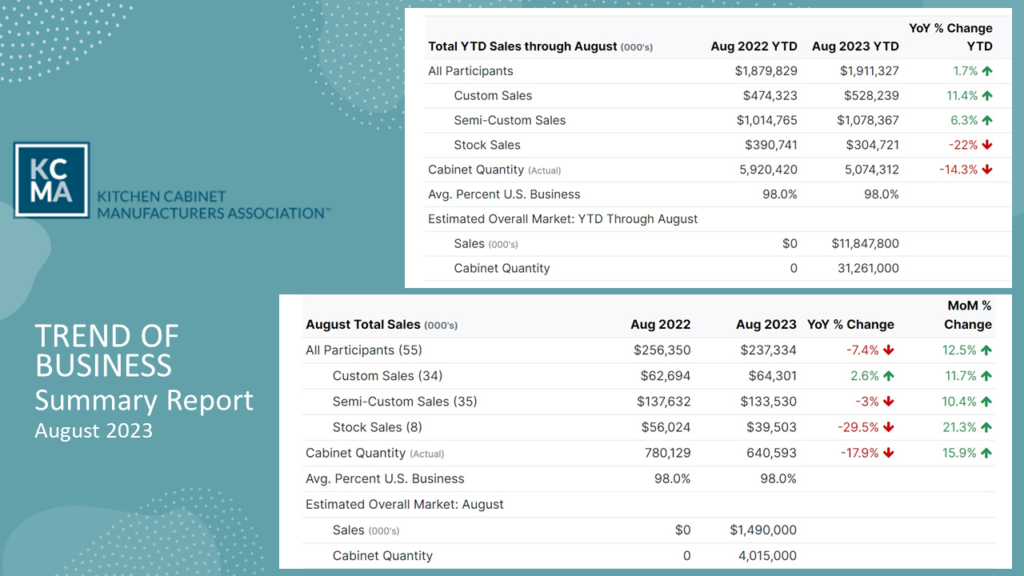

Custom and semi-custom cabinet sales increased from August 2022 to August 2022, rising by 11.4 percent and 6.3 percent respectively. These positive gains, however, were muted by stock sales, which took a YTD drop of 22 percent.

According to the Kitchen Cabinet Manufacturers Association’s Trend of Business Report, August’s year-to-date sales were $1,879,829 in August 2022 and rose 1.7 percent to $1,911,327 in August 2023.

In terms of monthly sales comparison, August 2023 compared to August 2022 is down 7.4 percent. However, when compared to July 2023 numbers, which were $211,047, sales were up 12.5 percent.

Estimated year-to-date sales through August were $11,847,800, according to KCMA statistics. In July 2023, YTD sales were $10,357,800.

In recent years, recycled building materials have become increasingly popular in the world of construction and home design. From glass to newspaper, your recyclables are being turned into a wide range of unique and useful building materials. Here’s a closer look at some of the latest advancements.

In recent years, recycled building materials have become increasingly popular in the world of construction and home design. From glass to newspaper, your recyclables are being turned into a wide range of unique and useful building materials. Here’s a closer look at some of the latest advancements.