US Construction spending grows 4.6% Y-O-Y

Residential construction up 4.2% Y-O-Y.

Non-residential construction up 4.9% Y-O-Y.

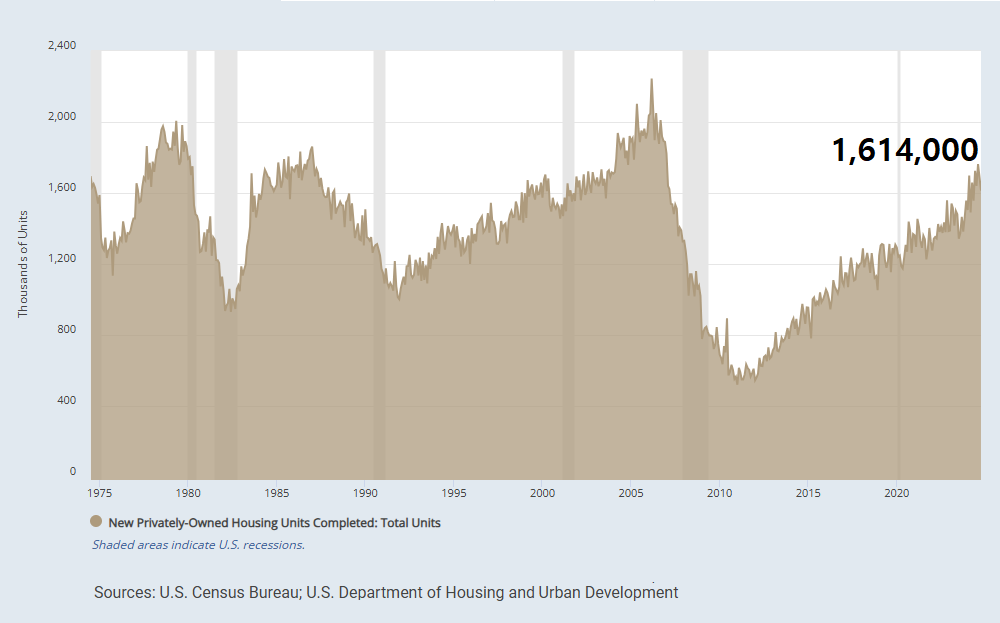

Housing completions grow 16.8% Year-Over-Year!

Building Permits

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,416,000. This is 7.7% below the October 2023 rate of 1,534,000. Single-family authorizations in October were at a rate of 968,000. Authorizations of units in buildings with five units or more were at a rate of 393,000 in October.

Housing Starts

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,311,000. This is 4.0% below the October 2023 rate of 1,365,000. Single-family housing starts in October were at a rate of 970,000. The October rate for units in buildings with five units or more was 326,000.

Housing Completions

Privately-owned housing completions in October were at a seasonally adjusted annual rate of 1,614,000. This is 16.8% above the October 2023 rate of 1,382,000. Single-family housing completions in October were at a rate of 986,000. The October rate for units in buildings with five units or more was 615,000.